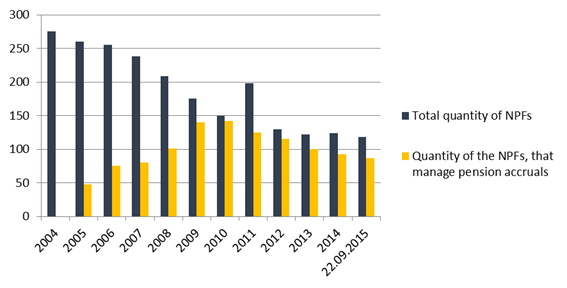

Today the NPFs market in Russia is provided by generally large funds, which control about 70% of the accumulated money in this sphere and attract about 65% of pension contributions and 70% of participants [1, P. 24]. The largest NPFs are located preferentially in Moscow and functioned across all Russia through a developed network of branch offices. I was possible to talk about development of NPFs of Siberia, which showed a poor development [2, P. 115], but in general were existing several years ago, now the market of NPFs of Siberia is provided by branches of the largest Moscow companies. The quantity of the NPFs, which are realizing activities according to license of the Central Bank of the Russian Federation steadily decreases (look at the figure 1). During the period from 2004 to 2015 the quantity of NPFs decreased more than twice. Such tendency is caused by tightening the legislation and requirements from the government authority.

|

|

Figure1. Dynamics of quantity of NPFs in the Russian Federation [3, P. 40]

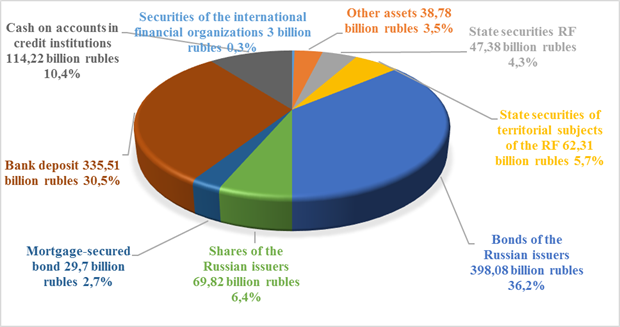

The structure of an investment portfolio of the Russian NPFs following the results of 2014 is provided in the figure 2. Generally it consists of deposits and cash money accounts in credit institutions (about 41%), and also bonds of the Russian issuers (about 36.2%). According to the data of the Central Bank of the Russian Federation as of 01.08.2015 the share of a bank deposits and a cash bank accounts was reduced to 35.4% inside of an investment portfolio. The share of the bond of the Russian corporate issuers grew and made 38.2% of a portfolio. Besides, the part of shares grew (it made 8.6% of a portfolio) [4].

Figure 2. Structure of a total investment portfolio of NPFs by the end of 2014 [3, P. 40]

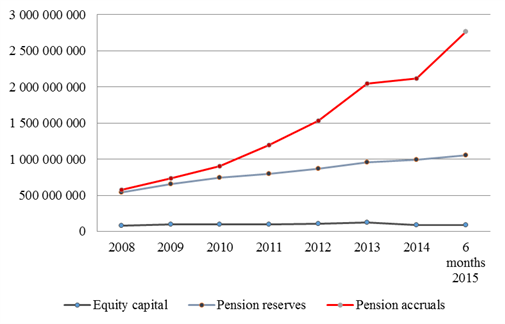

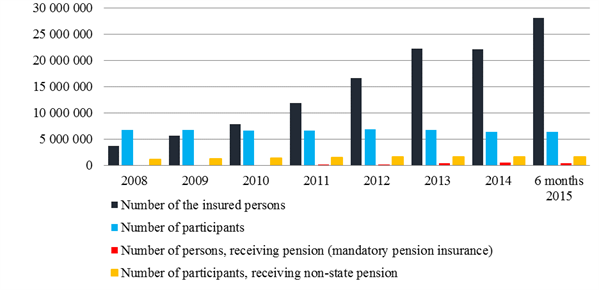

Dynamics of the main activity indices of NPFs is positive, in particular, the value of equity capital, the volume of pension accruals and pension reserves (figure 3), the number of participants and the insured persons grows stationary (a figure 4).

In the figures 3 and 4 growth of the citizens’ activity regarding cooperation with NPFs in the first half of 2015 is well shown. So, according to Pension Fund of the Russian Federation (in abbreviated form is RPF) during the period from January to June 2015 477.6 thousand assertions to change the RPF for NPF and 407 thousand assertions to change one NPF for another NPF [5]. Thus, despite aims of State authorities, the prohibition to make decision about changing the PFR for any NPF after 2015, more promoted to rise interest of the citizens in NPFs. As the reason of high activity also can serve traditionally low profitability of the State management company of Vnesheconombank (in abbreviated form is VEB). For the first half of the 2015 it made 12.2% on an expanded portfolio, it is below than official inflation rate).

Figure 3. Dynamics of indices equity capital, pension reserves, pension accruals, thousand rubles [3, P. 41]

Figure . Dynamics of number of participants of NPFs in the Russian Federation [3, P. 41]

Thus, in 2015 the role of NPFs the major indices of their activities increased, despite a financial crisis in Russia economy and in pension system, in particular. Pension reform does not completed, because today many questions according to it are discussing. The pension accruals are a basic element and a factor of development of non-state pension system in Russia. Therefore, it is important to save system of mandatory funded pension, and also to save a possibility of citizens to choose NPFs.

References

- Orlov S. Non-state pension funds in pensions provision system of the Russian Federation. S. Orlov, A. Shemetov // Zaural’skij Nauchnyj Vestnik. – 2013. – № 1 (3). – P. 20–26.

- Belomyttseva O. Development of non-state pension funds of Siberia (on the example of Novosibirsk, Tomsk and Kemerovo regions) / O. Belomyttseva, Ya. Titkova // Tomsk State University Journal. – 2007. – № 299. – P. 115-121.

- Lavrenova E. Review of the market of non-state pension funds in the Russian Federation / Е. Lavrenova, О. Belomyttseva // Problems of Accounting and Finance. – 2015. – № 2. – P. 39–44.

- News of the market of non-state pension funds [Electronic resource] // National association of non-state pension funds. – Electronic data. – URL: http://www.napf.ru/ (access date: 09.05.2016).

- The Pension Fund of the Russian Federation [Electronic resource] // PFR. – Electronic data. . – URL: http://www.pfrf.ru/ (access date: 29.04.2016).

- The PFR approves funded pension in a voluntary basis employees [Electronic resource] // Accounting, taxation, audit. – Electronic data. – URL: http://www.audit-it.ru /news/personnel/859987.html (access date: 05.05.2016).

- Non-state pension funds [Electronic resource] // InvestFunds. – Electronic data. – URL: http://npf.investfunds.ru/ (access date: 11.05.2016).

- The Central Bank of the Russian Federation [Electronic resource] // Bank of Russia . – Electronic data. . – URL: http://www.cbr.ru/sbrfr/?PrtId=polled_ investment (access date: 10.05.2016).

View this article in Russian

View this article in Russian